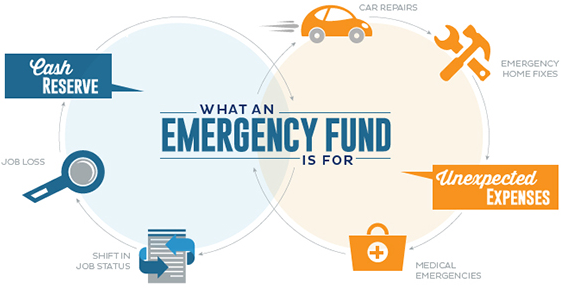

You should only dip into your emergency fund for a real emergency; to keep yourself afloat between jobs, for a car repair, a medical expense, or a home repair. You cannot use your emergency fund for things like a vacation, a shopping spree or to upgrade your perfectly good cell phone or laptop.

An emergency is not an expected expense like kids higher education or their weddings or your retirement, that you didn’t budget for a few months ahead of time. That’s what a sinking fund is for.

Saving accounts is not an emergency fund

Is your savings account your Emergency Fund too? If that is the case then there are chances that you may not be able to meet your day-to-day needs in times of emergencies. Savings account is that one stop solution which fulfills all your needs and can fulfill all your wants. Hence it's difficult to control the urge of leaving that exotic vacation or that latest smart phone or that weekend party etc. just for fighting with those unforeseen emergencies that may or may not come.

What if emergencies hit you when you don't have enough money in account!!

DON'T DIP INTO OTHER GOALS SAVINGS

Financial Assets offer the ease to withdraw at will. This often turns out as the biggest disadvantage when all financial assets are treated as money in hand. Emergencies create worrisome situations and leave us in despair. To combat such times we tend to dip into the savings done for other goals. If you will do it once, you will do it again and again whenever you need money.